An Overview of Recovery of Shares

Earlier, investments in shares were carried out via physical share certificates. The investment made in a company in the form of debentures/shares by the investors was granted in physical form. Such debentures or shares being in paper form were difficult to store & easily losable& destroyable. There could be various reasons for such unclaimed shares in physical form, such as torn shares, lost shares, unclaimed shares, forgotten shares, death of an actual shareholder, and dismantled shares. Many people in India invest their money into shares & forget to claim them, or many of them expire before claiming them. So to resolve these problems, the Ministry of Corporate Affairs introduced IEPF or Investor Education & Protection Fund to make sure that the unclaimed shares can be transferred to and received by the right person.

Swarit Advisors is your one-stop destination to claim such unclaimed shares & does it for you uniquely & differently. At Swarit Advisors, you will get complete assistance for all your doubts & queries related to the recovery ofshares, issue of duplicate shares, name deletion, transfer of shares, transportation of shares, etc. Swarit Advisors will help you in recovering your unclaimed shares.

What is IEPF?

IEPF, or Investor Education and Protection Fund, was introduced by the Central Government of India (GoI) to protect the interests of investors and promote awareness. IEPF is established under Section 125 of the Companies Act 2013. The unclaimed or unpaid amounts belonging to a Company’s investors are pooled & credited into the IEPF.

The IEPF is administrated by the IEPF Authority consisting of a chairperson or a CEO and such other members, not exceeding 7 appointed by the Central Government of India. The IEPF Authority manages the IEPF funds and maintains separate accounts & other relevant records relating to the funds as prescribed after consultation with the Comptroller & Auditor-General of India. The funds of the IEPF are the amount accumulated or credited to the IEPF in accordance with the provisions of the Act. The IEPF Authority will utilise & spend money of the IEPF funds only for the purposes prescribed under the Act. The Comptroller & Auditor-General of India will audit the accounts of the IEPF the IEPF accounts. The Authority will forward the accounts with the audit report annually to the Central Government of India.

Who is Eligible to Apply for Recovery of Shares from the IEPF Authority?

Any shareholder whose unclaimed shares have been transmitted to the IEPF can claim the refund of shares by simply applying to the IEPF Authority. However, a claimant can make only one consolidated claim regarding a company in a Financial Year. The aggregated claim should include the data of various Folios from the same Company.

When the claimant is the nominee, legal heir, or successor of the registered Shareholder, he or she should ensure that the Company completes the share transmission procedure & issues an entitlement letter before filing the IEPF Claim with the concerned authorities.

Services Offered by Swarit Advisors

Following are some important services offered by Swarit Advisors:

Recovery of Shares

Recovery of Shares is to claim the unclaimed amount of Shares and this unclaimed amount is transferred to IEPF, which can be claimed only after following the proper procedure prescribed by IEPF & MCA. Swarit Advisors will provide end-to-end assistance, from filing the application to getting a refund from the IEPF.

- Documents Required for Recovery of Shares from IEPF:

- Documents to be filed by the claimant while applying for recovery of shares are-

- Claimant’s Information

- Details of the Company from which the amount is claimed

- Details of shared to be recovered

- Details of dividend amount to be claimed

- Details of claimant such as Aadhar Card, Citizenship, Passport, OCI, PIO card number, etc.

- Bank account details linked to Aadhar card

- DEMAT Account number.

- Documents to be submitted by the claimant for claiming for refund-

- Printout of the completely filled form along with the Signature of the claimant

- Copy of Acknowledgement along with the SRN Number

- Indemnity bond with Signature of the claimant on non-judicial stamp paper of amount specified in the Stamp act

- Original advanced stamp receipt with claimant and witness signature

- Share certificate original

- Aadhar card details of the claimant

- Entitlement proof

- In the case of NRIs and Foreigners- Passports and other details

- Cancelled cheque

- DEMAT account list copy

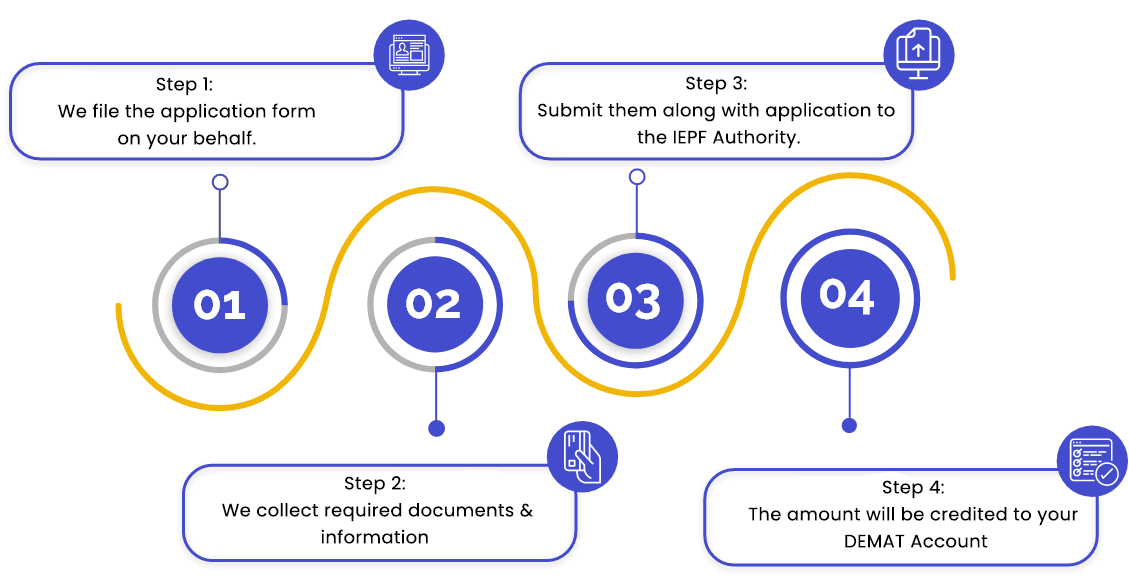

- Procedure for Recovery of Shares from IEPF:

Following is the step-by-step procedure for the Recovery of Shares from IEPF:

Step 1: Document Submission on the portal: The claimant or Client willing to apply for recovery of shares must submit the required form and documents to team Swarit Advisors.

Step 2: Submission of the Claim for a refund: After submitting the required form and document, the claimant is required to submit a copy of the form in an envelope titled “Claim for a refund from IEPF Authority” to the IEPF Nodal Officer or Registrar of the Company, along with the required documents.

Step 3: Claim Submission to IEPF Authority: After submitting the documents to the Company's IEPF Nodal officer, the Company is required to prepare a verification report within 15 days from the submission of the form. The verification report is then required to be submitted to the IEPF authorities along with the documents necessary to proceed with the recovery of shares.

Step 4: Receiving of Refund: After the report is submitted, the IEPF authority decides the claimant's reimbursement within sixty days from the submission date.

The IEPF authority issues a refund for recovery of shares when the claimant is entitled to those shares after seeking permission from the competent Authority. The IEPF officer sends a bill for paying the claimant, and the amount will be credited to the DEMAT account of the claimant.

Transfer of Shares

In terms of marketing, transferring the title of the Share Certificate from the Transferor to Transferee is known as the ToS or the Transfer of Shares. When you are holding shares in physical form & you are the legal heir of the concerned shares, and you are seeking to transfer such shares in your name, you can contact Swarit Advisors for all such transfer-related solutions. However, you may find some problems when trying to transfer multiple companies' shares to your name. Don't worry; swarit Advisors will help you in solving any of the problems mentioned below:

- Signature Mismatched: It normally happens that your signatures tend to change over a time period, likewise, especially if you are signing any documents after a long time period and your present signatures are not matching to the previous signatures in the record. At Swarit Advisors, our experts can help in updating your signatures with the Company's record.

- Non-Submission of Transfer Deed: This happens when a buyer has fairly paid the consideration amount but was not able to submit the Transfer Deed due to any reason. Certainly, the shares are still against the sellers' names. At Swarit Advisors, we can help you in transferring those shares to the buyers, wherein the shares are still in the seller's name.

- Recover Lost Shares: If your Share Certificates are lost due to any reason and you want to recover your shares, then there is a high possibility that you may not be able to recover the value of those shares. But you don't need to worry at all; our experts can help you recover those duplicate certificates in your/your Company's name and can make all of your efforts to get your possessions back easy & hassle-free.

- Torn or Dismantled Share Certificates: Improper care of Equity Share Certificates can tear & wear them and you might face big problems in the Transfer of Shares. So, if your share certificates are torn or dismantled, then our experts can seek a good solution to recover those shares.

Unclaimed Dividend

Companies announce dividends on shares yearly & when these dividends are unclaimed by the Shareholder for a consecutive time period of 7 years, they are transferred to the IEPF account. As an investor, you are also allowed to claim your Unclaimed Dividends even after the shares have been successfully transferred to the account of IEPF. There are a number of affected investors of unclaimed dividends in India, even after the constant efforts by the Government of India to ensure the security of unclaimed dividends, split shares, debentures, etc. If you are also one of the problems sufferers concerning Unclaimed Dividends or Shares, then you do not need to worry. Swarit advisors are always here to provide you with complete assistance. Following are some problems you may face at the time of recovering Unclaimed Dividends:

- No Execution or Improper Execution of Transmission of Transfer: Sometimes, the buyer's shares remain in the seller's name due to improper or no execution of the transfer. It usually happens in the case of physical shares. Similarly, in the instance of Share Transmission, if a legal heir or successor fails to do the correct & proper Transmission of Shares in their name after the death of the investor. It can happen due to any reason, such as lack of effort, negligence of the successor because of any reason, improper legal consultation, or fraud from the concerned Company.

- Expired Records: The main reason for the existence of unclaimed dividends is the wrong or outdated details of shareholders. A mismatch of any person's information, comprising name, age, husband or father's name, DoB& address, can put one's shares into unclaimed dividends.

Transmission of Shares

It means transferring the shares by Operation of Law (OoL), i.e., Transfer of Shares (ToS) in the legal heir after the death of the actual Shareholder. The Legal Heir faces many problems with the Transmission of Shares due to reasons including death, insolvency, lunacy, and bankruptcy or due to any other reasons except natural transfer. Once you have registered for the Transmission of Shares with a Company, you are not only the Shareholder; you are also entitled to all the rights.

Sometimes Transmission of Shares becomes very inept and it can take a toll on you, particularly if you are not seeking proper professional advice. We at Swarit Advisors are providing assistance to our respected clients on various problems concerning Share Transmission. Following are some possible challenges you might face at the time of the Transmission of Shares:

- Multiple Holdings in Different Companies: If you have numerous holdings in different companies, and if you want successful transmission of shares, then you must have to send the crucial documents to each Company & do the follow-ups constantly as per different policies of different companies.

- Mix-up of Transmission of Shares & Transfer of Shares: This is one of the most common problems faced by shareholders. The Companies Act highlights the difference between the Transmission of Shares & Transfer of Shares. The Transfer of Shares totally depends on the Act & decision of the Shareholder, while the Transmission of Shares is totally inclined to the operation of laws. In the instance of Transmission of Shares, shares are transmitted only by inheritance or will, while the Transfer of Shares is not always done with exact consideration.

- Jointly Held Securities: You can also face many problems in the Transmission of Shares when you are one of the joint holders. In the case of jointly held securities, our experts can help you in name deletion of the other Shareholder either by Operation of Law (in the case of death of joint holder)/either when you are seeking the same voluntarily.

Issue of Succession Certificate

A Succession Certificate is a certificate issued by a Competent Court (civil) certifying a correct person to be the successor of a deceased person. This Certificate authorises successor(s) to realise the debts & securities of the deceased person. At Swarit Advisors, we have a team of experienced lawyers & advocates who can help in drafting & filing the petition together with representation before the relevant court.

Conversion of Physical Shares to the Demat Form

Dematerialisation of shares is the process of converting the Physical Shares to the Demat Form. An investor intending to dematerialise its securities needs to have an account with a DP. The Client has to deface & surrender the Certificates registered in its name to the DP. Our experts at Swarit Advisors will help you in creating a Demat account and conversion of shares.

Recovery of Provident Fund

A Provident Fund is a voluntary investment fund that aids individuals in achieving their financial goals. The Government managed retirement savings scheme enables employees to contribute a portion of their income towards this pension found on a monthly basis. We have a team of experts to help our customers in recovering Provident Funds.

Recovery of Insurance Claims

Such claims refer to a formal request by the policyholder to the insurance company for the coverage of the loss. As per the research, around 12,000 crores of unclaimed money in India lies with insurance companies. Swarit Advisors will help you in recovering all of your insurance claims without any hassle.

The following are the reasons behind the pending insurance claim:

- Death of Policy Holder: When taking the insurance policy, it is advisable to give the nominee's name else; there is no use of an insurance policy. If the holder of the insurance policy dies before the maturity period, then the nominee gets the money which is called Death Claim. However, suppose that you named the nominee when the policy started, and he or she died & you haven't changed the nominee's name in the policy. In this case, if the holder of the policy dies, then the settlement of the claim becomes complicated and there requires an intervention of the court to get the Succession Certificate to prove that you are the legal heir. All this process requires time & extra expenses. So you do not need to worry; we have an experienced lawyer who can help you with this in a minimal time.

- Loss of Insurance Policy Paper: This is a common problem among insurance policyholders; they take the policy but cannot handle their papers properly. Imagine that you took the policy of an Insurance Company. But you do not have to worry about it. We at Swarit Advisors help you to get your duplicate paper from the Insurance Companies.

Issue of Duplicate Share Certificate by Listed Company

In case the Shareholder misplaces or lost the original share certificate, then a Listed Company issues a Duplicate Share Certificate. Our experts at Swarit Advisors will help you in issuing Duplicate Share certificates.

Name Updation or Deletion in Shares

The name updation or deletion occurs in case of abscondment or death of one of the joint shareholders. The surviving Shareholder needs to apply for the updation or deletion of the name in such conditions by simply applying with the Company or RTA. Our experts will support you in the process of name updation or deletion in the shares.

Recovery of Mutual Funds

Many individuals or people invest their money in mutual funds & then forget about them. However, the catch here is that these investments can't be traced from the MCA or IEPF but from the Mutual Funds themselves. The process to recover Mutual Funds is the same as the procedure or process for the Recovery of Shares.

Transfer of Disputed Shares through NCLT

If the Company rejects the application for the Transfer of Shares by the Shareholder, then the proposed Shareholder can approach NCLT to get an order for the Transfer of Shares (ToS) by the Company by claiming for the same. Our services will provide the end-to-end solution of all the pending litigation before NCLT, filing any litigation &representing the Shareholder before the tribunal.